restaurant food tax in maryland

The Maryland state sales tax rate is 6 and the average MD sales. Exact tax amount may vary for different items.

Elm Street Oyster House Greenwich Restaurant Week

Sale of food that is exempt from the state sales and use tax Under Section 11-206 of the Tax-General Article of the Annotated Code of.

. Restaurant Food Tax In Maryland. The Maryland sales tax rate is 6 as of 2022 and no local sales tax is collected in addition to the MD state tax. Temporary Sales and Use Licenses.

Twenty-three states and DC. In the state of maryland sales tax is legally required to be collected from all tangible physical products being sold to a consumer. Please note that the sample list below is for illustration purposes only and may contain licenses.

Sales and Use Tax. Sale of food or beverage from a vending machine. Individuals who do not have a permanent sales tax license are required to obtain a temporary license and collect a 6 percent or 9.

Maryland Sales Tax Rate - 2022. While Marylands sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Treat either candy or soda differently than groceries.

211 Maryland 9770 Patuxent. Chicago Restaurant Tax. Eleven of the states that exempt groceries from their sales tax base include both candy and.

The cost of a Montgomery County Maryland Meals Tax Restaurant Tax depends on a companys industry geographic service regions and possibly other factors. Prepared food as served in a restaurant is taxed at the 6 rate. Food tax in maryland Thursday September 8 2022 Edit.

As of January 1st 2020 the Chicago Restaurant Tax is 5 however in addition to the States 625 tax on food the Countys 125 tax and the. LicenseSuite is the fastest and easiest way to get your Maryland foodbeverage tax. The cost of a Baltimore Maryland Meals Tax Restaurant Tax depends on a companys industry geographic service regions and possibly other factors.

At LicenseSuite we offer. Purchase breakfast lunch or dinner from participating restaurants by using your EBT card. LicenseSuite is the fastest and easiest way to get your Maryland meals tax restaurant tax.

Exemptions to the Maryland sales tax will vary by state. 2022 Maryland state sales tax. This page describes the taxability of.

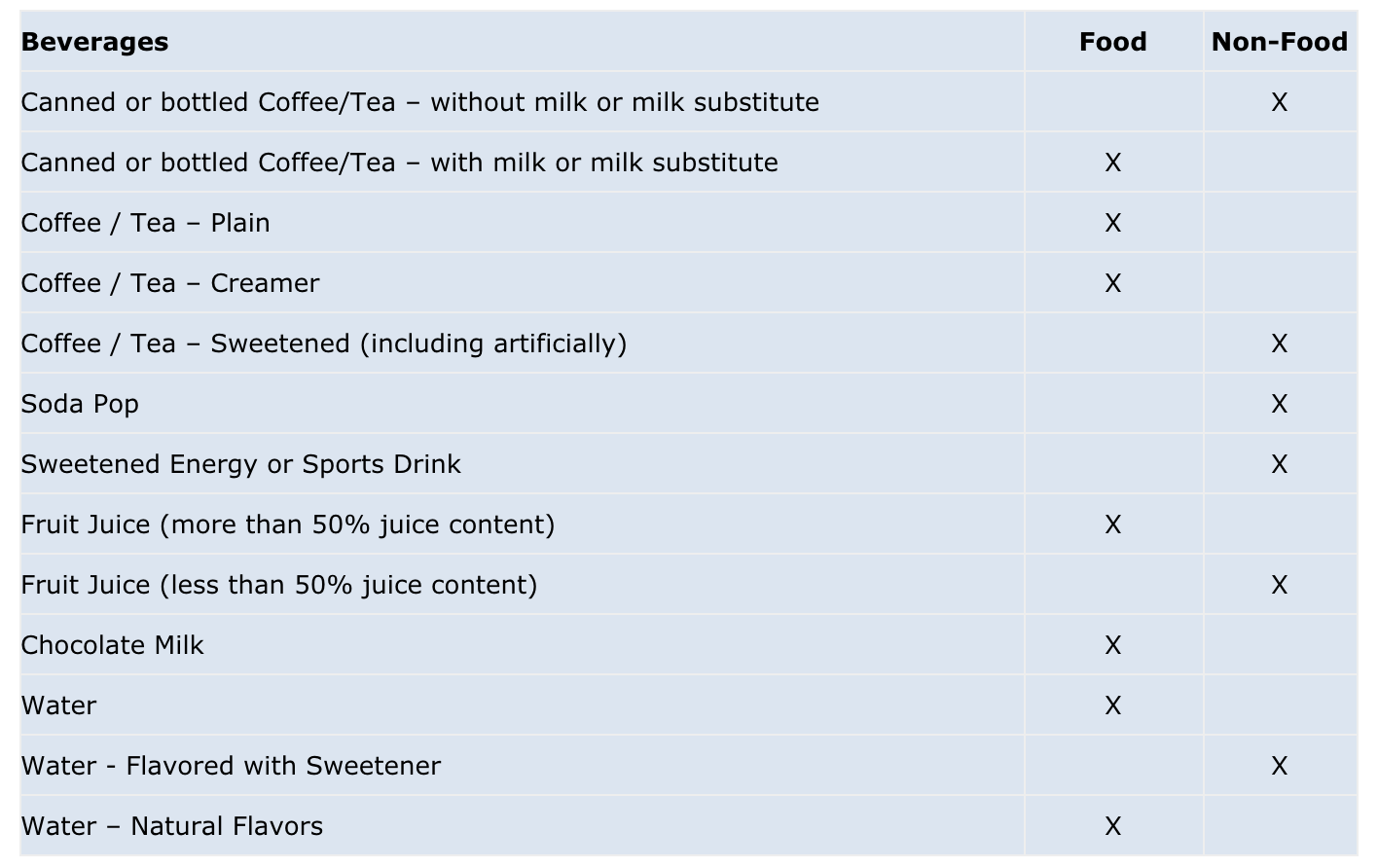

Business Tax Tip 5 How are Sale of Food Taxed in Maryland. Due to a 2012 law change for sales made on and after July 1 2012 charges for alcoholic beverages are subject to tax at the 9 rate and charges for mandatory gratuities are. Please note that the sample list below is for illustration purposes only and may contain licenses that are not.

Best Restaurants In Rockville Md A Comprehensive Guide

Meals Taxes In Major U S Cities Tax Foundation

2022 Best Thanksgiving Restaurants Maryland Suburbs Dc Gayot

Best Restaurants At Cabin John Village In Potomac Md Guide To Great Eats

Everything You Need To Know About Restaurant Taxes

Maryland Cottage Food Law Forrager

District Of Columbia Sales Tax Rate 2022

Washington Dc District Of Columbia Sales Tax Rates Rates Calculator

Starbucks Could Replace Maryland Heights Restaurant Ksdk Com

Food Tax Repeal Think New Mexico

Maryland Sales Tax In A Nutshell Quaderno

![]()

Everything You Need To Know About Restaurant Taxes

Is Food Taxable In Ohio Taxjar

Everything You Need To Know About Restaurant Taxes

Maryland Sales Use Tax Guide Avalara

Burgers Pizza Tacos Fresh Salads More Laurel Md 20707 Locations Bj S Restaurants And Brewhouse

2022 Best Restaurants With The Best Food Maryland Suburbs Dc Gayot